Tom Piwaron

Senior Sourcing Manager

Will Scherbarth

Senior Sourcing Associate

Carl Hoeg

Strategic Pricing Manager

Josh Bender

Senior Transportation Manager

Q. What should partners in the Senior Living industry know about the current economic environment?

Tom: Residential furniture sales are at an all-time high. With virtually no discretionary spending happening on travel, dining, entertainment, etc., consumers focused on their homes. Further, low interest rates and multiple stimulus packages fueled an unprecedented demand for furniture. On the supply side, the US is facing a few hurdles. The foam shortage resulting from poor demand planning and bad weather is one hurdle. The other is a massive trade imbalance with China that is manifesting in skyrocketing container costs and long lead times.

Will: On the domestic side, the combination of COVID-19 mitigation (fewer production lines running) and labor inputs (furloughs, layoffs, etc.) have made ramping up production to meet the demand virtually impossible. As more states reopen and key industries such as hospitality lead the commercial rebound, production is likely to continue to trail demand.

Carl: We are in a historic period of price and cost increases. In the last twelve months, inflation is up 5.0% and the cost of production is up 6.6%. Typically these metrics fluctuate in the 1 to 3% range and it has been more than a decade since either was this high. This is being driven by U.S. and global macroeconomic forces that realistically are impacting all industries and companies. As such, customers should plan and budget accordingly for price increases over the coming months regardless of what they buy or who they buy from.

Josh: From a transportation perspective, there are several elements of the current environment worth noting. First, on the international inbound side, ocean container rates from the Asia Pacific region are at an all-time high: 2 to 3 times and more than what they were pre-COVID. There is a shortage of containers where they need to be – many are in transit to or within the consuming countries (like the US) and not available in the producing countries (like China) when they are needed. This is likely a shorter-term issue, but the bigger question is whether or not the actual ocean carriers will drop the price of containers and normalize the price to more common rates. We are seeing elements of supply manipulation as sailings are being cancelled more often, creating even more scarcity of resources, thereby keeping the price of containers high. It remains to be seen whether that is a conscious effort or a byproduct of another pressure on the network.

Domestically, transportation costs are rapidly escalating due to the fact that demand is exceeding shipping supply primarily due to the shift to purchasing via e-commerce instead of traditional brick and mortar locations. This is in turn has caused a spike in labor/driver rates as well as higher fuel costs. In addition, this has led carriers to restrict capacity. We are working tirelessly to mitigate these changes and ensure that we have capacity to deliver!

Q: What is driving the pricing increases for products?

Josh: Domestic and International transportation costs for both raw materials and finished goods has risen dramatically compared to pre-pandemic levels. This is one of may inputs that is pushing product costs higher.

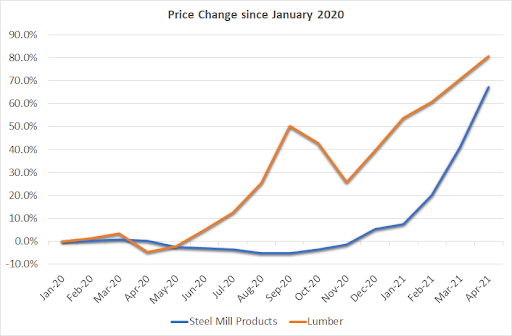

Carl: Product pricing is being driven up by a perfect storm of raw material increases, rising freight rates, supply chain disruption, product scarcity and a labor shortage. Raw materials have increased substantially over the past 12 months. Lumber and steel, for example, are both up nearly 80% in the last year (reference Price Change chart below). Alternatively, on the transportation side, demand to ship products both domestically and internationally has pushed freight rates higher. The inability to ship or get product at times has also led to product scarcity and supply chain disruptions which also pushes product pricing up. Finally, add to all this a labor shortage that is causing companies to have to pay more to compete for labor which they then pass along through price increases. All these factors together create an environment that will continue to push prices upward in the coming months.

Q: What is driving the shipping delays?

Josh: The sheer volume of freight moving in the system is the primary cause. Additionally, there are labor challenges. Warehouse jobs are hard work and often do not pay what workers are demanding. Truckers are in short supply and are part of an aging workforce in general. These labor issues and the record volumes in the networks are causing the delays.

Q: Do you anticipate that lead times and pricing will return to “normal?” If so, when?

Josh: I do believe that pricing will plateau and correct to a limited degree. I don’t think it is sustainable for containers to be 2x or 3x what they were 18 months ago. There is enough competition with the large 5 to 6 players that someone will undercut once the physical containers become more available and volumes inevitably decrease at some point. Freight is cyclical in the domestic market. We are in a seller’s market now, and at some point they will want volume again and shippers with volume will have more leverage relative to what they have today. The question will be when will that happen and to what extent. The timing of that is anyone’s guess. A decline in consumer volume, either by an economic downturn or other reason, will likely result in a buyer’s market. But depending on the cause, transportation costs may be the least of our worries if the economic situation is dire.

Will: Like transportation, I believe there will be a plateau and, for some categories, a return to pricing “normalcy.” Timing, however, is difficult to pinpoint. Some price easing will be driven by cooling demand, but most of the deflation will follow the cost of raw materials. Lead times will have a similar story, but may return faster due to easing of COVID-19 restrictions and increased labor availability, allowing manufacturers to boost production capacity. Another aspect to keep an eye on is how fast commercial demand, especially in hospitality, returns. If it coincides with an already hot residential market, pricing and lead time challenges will continue.

Q: Do you anticipate that things will get worse before they get better? Will any other product categories be impacted?

Josh: For transportation, I think – and hope – we are at the peak of cost and carrier leverage for this cycle. We cannot know for sure until we look back in 5 years, but I would anticipate things generally getting better with some possible exceptions of certain product types or something that carriers realize they simply don’t want to handle anymore.

Carl: From a pricing perspective, I would expect prices to continue to rise in the coming months as the U.S. and global economy continues to emerge from the pandemic and sort through pent up demand and limited supply. Until a new equilibrium is reached on a number of fronts (transportation capacity, product supply and demand), the economics dictate that prices will continue to increase. Realistically, most products will be impacted in some way, shape or form as almost everything is some combination of raw materials, transportation and labor. Products that may see less impact are those that did not see as large of a drop or rise in demand and production throughout the pandemic.

Q: What is Direct Supply doing to get products to Senior Living communities quickly and at the best cost?

Will: From a products perspective, Direct Supply has built a strong network of suppliers. This network has the understanding that with Direct Supply, they have a unique mission in serving seniors. Where possible, our supplier partners have withheld or delayed some price increases and, in some instances, prioritized orders. We’ll continue to work with our supplier partners to ensure the best for our customers, but we have to acknowledge the challenging environment.

Josh: From a transportation perspective, we partner with dozens of carriers. When one carrier is struggling to pick up or deliver on time, we have the top 5 competitors for that lane next in line ready to go. We are doing our best to make sure our carrier partners understand that Direct Supply is a healthcare company, helping those that are most vulnerable during this pandemic and serving an industry that is often neglected by society – by both political decisions and funding. We have a solid group of carriers that is helping us with our mission to serve seniors, but we are not immune to the struggles of the entire transportation network globally.

Contact us with any questions – we’re always here to help.